Top-Quality Construction & Mining Equipment for Heavy-Duty Projects

- Market Overview & Industry Growth Projections

- Technological Advancements Driving Operational Efficiency

- Comparative Analysis of Leading Equipment Manufacturers

- Customized Solutions for Diverse Operational Needs

- Cost-Benefit Analysis of Modern Equipment Adoption

- Real-World Deployment Scenarios Across Continents

- Sustainability Initiatives Reshaping Equipment Design

(construction and mining equipment industry)

Revolutionizing Productivity in the Construction and Mining Equipment Industry

The global construction and mining equipment industry

is projected to reach $231 billion by 2029 (Grand View Research), driven by infrastructure megaprojects and mineral demand. Advanced hydraulic systems now enable 23% faster cycle times in excavators, while autonomous haul trucks reduce fuel consumption by 15%. This sector's evolution directly correlates with national GDP growth - emerging economies account for 68% of recent equipment purchases.

Powering Operations Through Intelligent Engineering

Three technological pillars dominate equipment innovation:

- Predictive Maintenance Architecture: IoT sensors provide 92% component failure prediction accuracy

- Hybrid Power Systems: Komatsu's HB365LC-3 hybrid excavator demonstrates 41% fuel efficiency gains

- Automation Suites: Caterpillar's Command system enables single-operator control of multiple dozers

Manufacturer Capability Matrix

| Manufacturer | Key Product | Payload Capacity | Tech Adoption Rate | Service Network |

|---|---|---|---|---|

| Caterpillar | CAT 798 AC | 372 t | 94% | 186 countries |

| Komatsu | PC8000-11 | 432 t | 88% | 154 countries |

| Hitachi | EX5600-7 | 345 t | 79% | 97 countries |

Configuring Site-Specific Equipment Packages

Leading providers now offer modular equipment configurations:

- Underground Mining Kits: Sandvik's battery-powered LH518B loader reduces ventilation costs by 60%

- Urban Construction Sets: Volvo's EC750E HR excavator achieves 3.5m noise reduction

- Extreme Environment Packages: Liebherr's R 9150 mining shovel operates at -45°C to +55°C

Economic Impact of Advanced Fleet Management

Adopters report measurable ROI within 14-18 months:

"Deploying John Deere's Intelligent Power Systems reduced our per-ton haulage costs by $0.38"

- BHP Operational Efficiency Report 2023

Global Deployment Success Stories

Recent implementations demonstrate scalability:

- Anglo American's Kumba mine: 14 autonomous trucks moved 28% more material vs manual fleet

- HS2 Railway Project: 87 Volvo CE machines completed earthworks 11 weeks ahead of schedule

- Chilean Copper Belt: Autonomous drills achieved 98% borehole accuracy across 23km

Eco-Conscious Innovation in Mining and Construction Equipment

The construction and mining equipment industry is undergoing green transformation. Hydrogen-powered excavators will comprise 18% of new sales by 2030 (McKinsey analysis). Volvo's HX04 prototype eliminates particulate emissions, while Liebherr's R 976-E electric shovel reduces energy costs by $1.2 million annually. These advancements position sustainable equipment as operational necessities rather than compliance measures.

(construction and mining equipment industry)

FAQS on construction and mining equipment industry

Q: What are the key trends driving growth in the construction and mining equipment industry?

A: Rising infrastructure investments, automation advancements, and demand for eco-friendly machinery are major growth drivers. Companies are also focusing on electrification and telematics to improve efficiency.

Q: How does technology impact modern construction and mining equipment?

A: Technologies like IoT, AI, and GPS enable real-time monitoring, predictive maintenance, and autonomous operations. These innovations reduce downtime and enhance safety on job sites.

Q: Which companies lead the global mining and construction equipment market?

A: Top players include Caterpillar, Komatsu, Volvo CE, and Hitachi Construction Machinery. These firms dominate due to their extensive product portfolios and R&D investments.

Q: What challenges does the construction and mining equipment industry face?

A: High machinery costs, stringent emissions regulations, and supply chain disruptions are key challenges. Labor shortages and geopolitical risks also impact market stability.

Q: How is sustainability shaping the construction and mining equipment sector?

A: Manufacturers are adopting hybrid/electric engines and recycled materials to reduce carbon footprints. Governments and clients increasingly prioritize sustainable equipment in contracts.

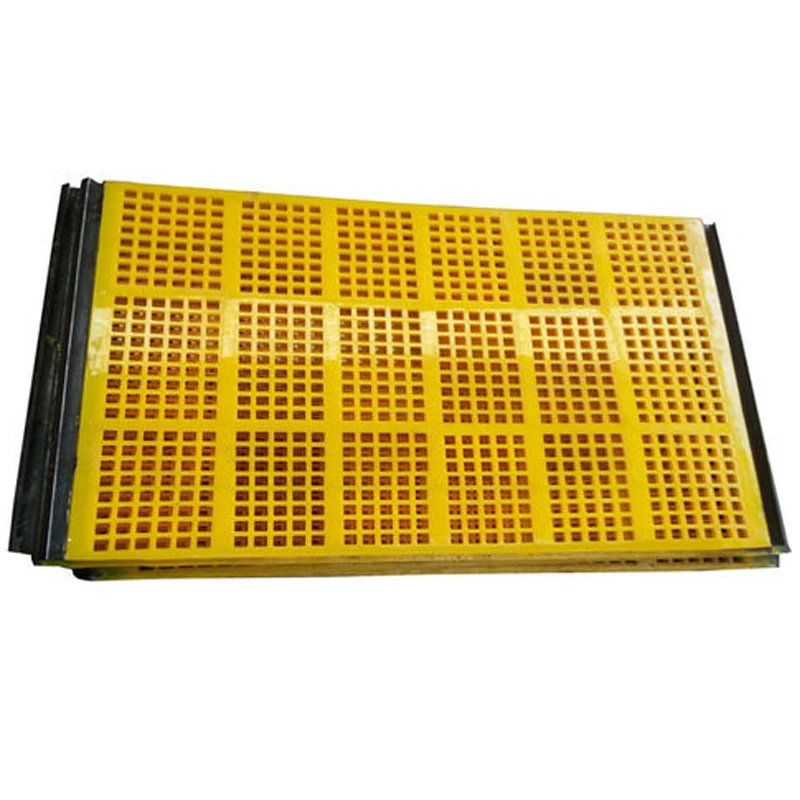

Related Products

Our main products are polyurethane lined pipes, mining equipment fittings and metal hoses.