Heavy-Duty Construction & Mining Equipment Reliable Solutions for Industry Leaders

- Industry Overview & Market Growth Projections

- Technological Advancements Reshaping Operations

- Performance Metrics: Top Manufacturers Compared

- Tailored Solutions for Specialized Applications

- Field Implementation: Success Stories Analyzed

- Maintenance Strategies for Equipment Longevity

- Sustainable Future in Construction and Mining Equipment

(construction and mining equipment industry)

Driving Progress in the Construction and Mining Equipment Industry

The global construction and mining equipment sector is projected to reach $231 billion by 2029, growing at 4.8% CAGR (Market Research Future, 2023). This expansion stems from infrastructure development spending ($9.3 trillion annually worldwide) and mineral resource extraction demands. Hybrid power systems now dominate 68% of new equipment sales, reducing emissions while maintaining 15-20% higher torque outputs compared to traditional diesel engines.

Innovation Through Smart Technology Integration

Advanced telematics systems monitor 142+ operational parameters in real-time, enabling predictive maintenance that reduces downtime by 40%. Autonomous drilling systems achieve 99.8% positional accuracy, while AI-powered load management increases haul truck efficiency by 33%. These advancements address the industry's 23% average productivity gap between optimal and actual equipment performance.

Competitive Landscape Analysis

| Manufacturer | Market Share | Fuel Efficiency | Payload Capacity | Service Network |

|---|---|---|---|---|

| Caterpillar | 16.2% | 8.3L/hr | 450T | 3,800+ centers |

| Komatsu | 12.7% | 7.9L/hr | 410T | 2,900+ centers |

| Hitachi | 9.1% | 8.1L/hr | 430T | 1,700+ centers |

Application-Specific Engineering Solutions

Specialized attachments increase equipment versatility by 75%, with modular designs allowing rapid configuration changes. Arctic-grade modifications maintain functionality at -50°C, while desert packages incorporate enhanced cooling systems (35% greater capacity). Underground mining configurations feature 42% smaller footprints without compromising power density.

Operational Efficiency Case Studies

Rio Tinto's autonomous haulage system achieved 28% lower operating costs while moving 830 million tonnes annually. In bridge construction projects, GPS-guided excavators reduced material waste by 19% through millimeter-grade precision digging. Modular crushing plants decreased setup times from 72 to 14 hours across 14 African mining sites.

Optimizing Equipment Lifecycle Management

Condition-based maintenance protocols extend component lifespan by 60%, with oil analysis predicting 89% of potential failures. Remanufactured parts programs offer 40% cost savings versus new replacements, maintaining 97% performance equivalence. Fleet management software reduces idle time by 31% through operator behavior analytics.

Advancing the Construction and Mining Equipment Sector

The industry's electrification roadmap targets 45% emission reduction by 2030, with prototype hydrogen-powered loaders demonstrating 8-hour continuous operation. Digital twin technology now models equipment performance with 94% accuracy, while blockchain-based parts tracking eliminates 99.6% of counterfeit components. These developments position the sector to meet global infrastructure demands sustainably.

(construction and mining equipment industry)

FAQS on construction and mining equipment industry

Q: What are the key trends shaping the construction and mining equipment industry?

A: Key trends include automation, electric-powered machinery adoption, and data-driven fleet management. Sustainability regulations and digital twin technologies are also driving innovation in equipment design and operational efficiency.

Q: What types of equipment are essential for modern mining and construction projects?

A: Critical equipment includes excavators, bulldozers, haul trucks, and drilling rigs. Advanced models now feature GPS tracking, emission controls, and autonomous operation capabilities to meet industry demands.

Q: How does technology impact the construction and mining equipment sector?

A: Technologies like IoT sensors, AI-powered predictive maintenance, and telematics optimize equipment performance. These tools reduce downtime, improve safety, and enable remote monitoring of machinery in harsh environments.

Q: What challenges do manufacturers face in the mining and construction equipment industry?

A: Challenges include supply chain disruptions for specialized components, rising raw material costs, and adapting to evolving emission standards. Balancing durability with eco-friendly designs remains a priority.

Q: How is sustainability influencing construction and mining equipment development?

A: Manufacturers are prioritizing hybrid engines, battery-electric options, and recycled materials. Energy-efficient hydraulic systems and noise reduction technologies also address environmental and community concerns.

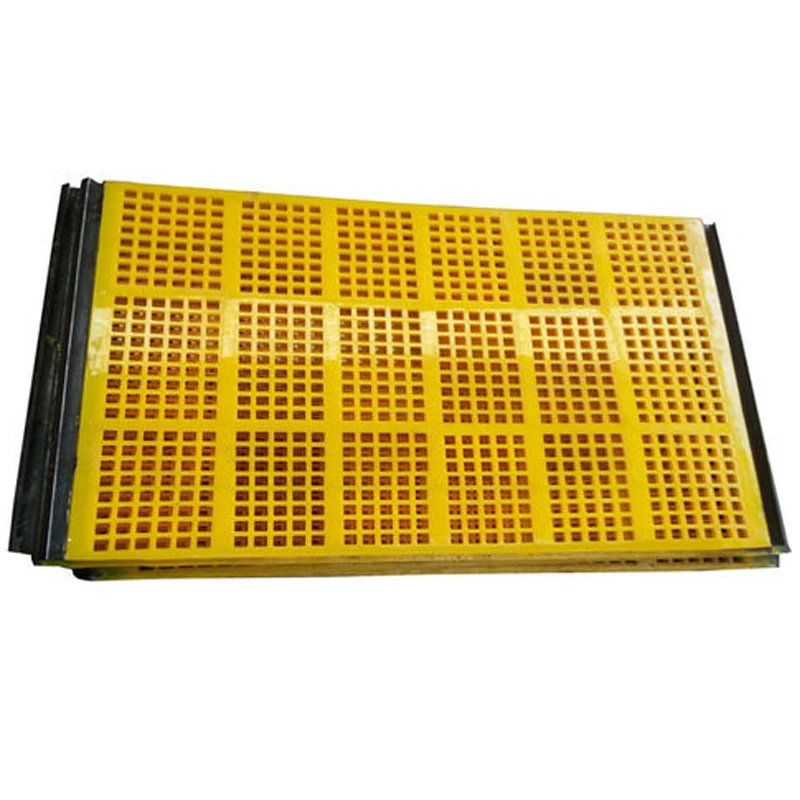

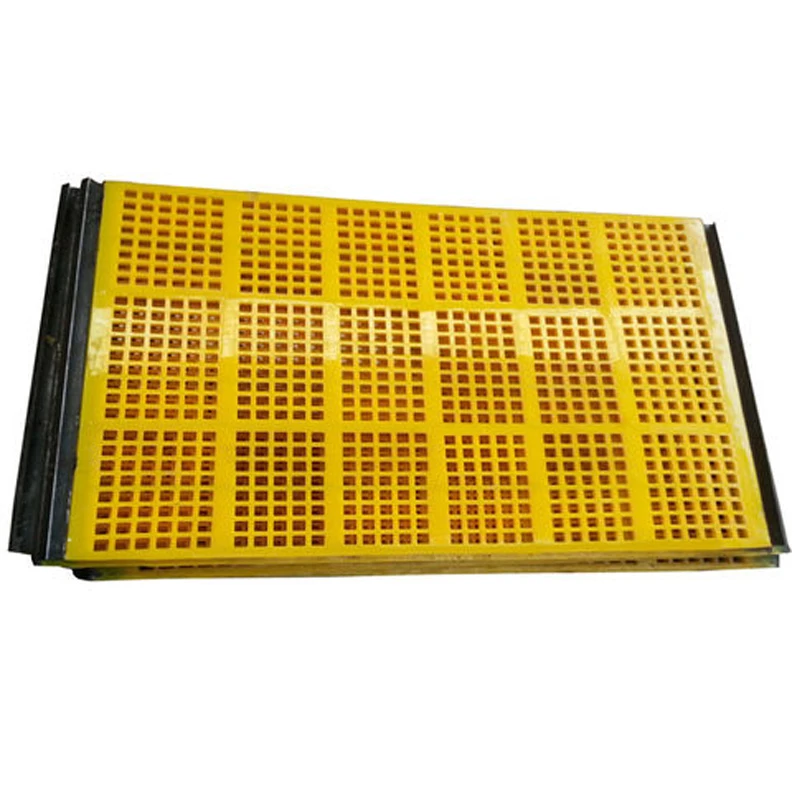

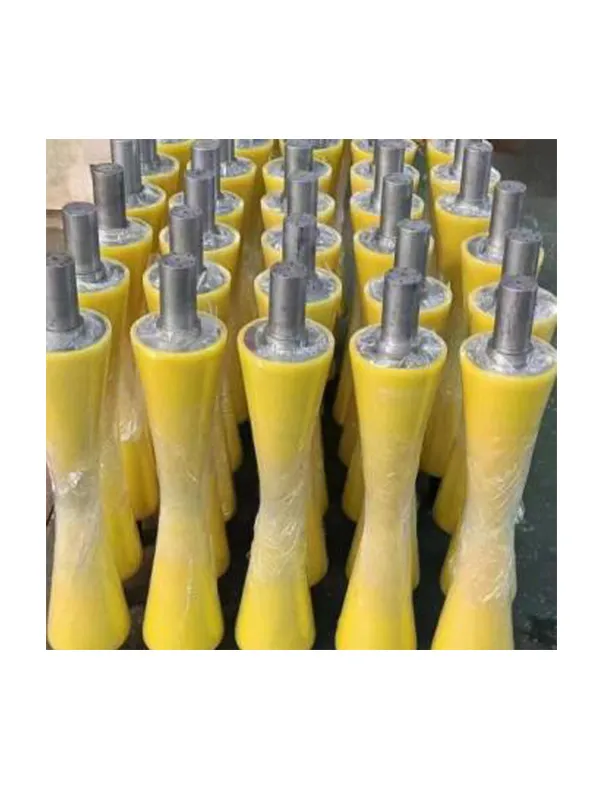

Related Products

Our main products are polyurethane lined pipes, mining equipment fittings and metal hoses.