Heavy-Duty Mining & Construction Equipment Durable Solutions

- Industry Overview & Growth Projections

- Technological Advancements Driving Efficiency

- Performance Comparison: Top 5 Equipment Manufacturers

- Custom Engineering Solutions for Complex Projects

- Field Applications: Mining vs Construction Scenarios

- Sustainability Initiatives in Heavy Machinery

- Future Trends in Mining and Construction Equipment

(mining and construction equipment)

Powering Progress: The Mining and Construction Equipment Landscape

The global construction and mining equipment industry is projected to reach $288.8 billion by 2031 (Statista, 2023), driven by infrastructure development and mineral demand. Autonomous haulers now demonstrate 23% fuel efficiency gains compared to traditional models, while electric excavators reduce site emissions by 41% on average. This sector's compound annual growth rate (CAGR) of 6.7% underscores its critical role in shaping modern industrial operations.

Innovation at the Core: Smart Machinery Evolution

Leading manufacturers have integrated IoT sensors in 78% of new equipment since 2020, enabling real-time performance monitoring. Caterpillar's Adaptive Control System improves digging accuracy by 34% through machine learning algorithms. Komatsu's Intelligent Machine Control bulldozers achieve grade precision within ±1.5cm, reducing manual rework by 60%.

Manufacturer Capability Analysis

| Brand | Key Technology | Market Share | Service Coverage |

|---|---|---|---|

| Caterpillar | Autonomous Haulage | 22.4% | 190 Countries |

| Komatsu | AI-Powered Grading | 18.1% | Global |

| Hitachi | Hybrid Excavators | 12.7% | Asia/EMEA |

Tailored Solutions for Operational Challenges

Specialized configurations now account for 38% of equipment sales, including:

- High-altitude engine packages (operational up to 4,500m elevation)

- Corrosion-resistant components for coastal operations

- Modular attachments enabling rapid task switching

Real-World Implementation Success Stories

A lithium mining project in Australia deployed 27 autonomous dump trucks, achieving 93% utilization rates. In Canada's Trans Mountain Pipeline expansion, GPS-enabled excavators moved 18M cubic meters of earth with 0.02% margin of error. These cases demonstrate how modern mining and construction equipment

delivers measurable ROI.

Eco-Conscious Engineering Breakthroughs

Volvo's EC950 electric excavator reduces noise pollution by 50% while maintaining 98% hydraulic efficiency. Cummins' Stage V engines cut particulate emissions to 0.015 g/kWh, exceeding EU standards. These advancements help projects meet 82% of sustainability KPIs in regulated markets.

Mining and Construction Equipment: Shaping Tomorrow's Infrastructure

With 73% of operators planning equipment upgrades by 2026, the industry is transitioning toward integrated digital ecosystems. Predictive maintenance systems now prevent 89% of unplanned downtime, while hydrogen-powered prototypes show 53% energy cost advantages. This evolution positions mining and construction equipment as the backbone of sustainable development initiatives worldwide.

(mining and construction equipment)

FAQS on mining and construction equipment

Q: What are the key trends driving growth in the construction and mining equipment industry?

A: The industry is growing due to rising infrastructure development, automation in equipment, and increased demand for sustainable machinery. Emerging markets and technological advancements like IoT integration also contribute to expansion.

Q: Which companies lead the global mining and construction equipment market?

A: Top manufacturers include Caterpillar, Komatsu, Volvo CE, Hitachi Construction Machinery, and Liebherr. These brands dominate through innovation, extensive product ranges, and strong after-sales support networks.

Q: What types of equipment are essential for modern mining and construction projects?

A: Critical machinery includes excavators, bulldozers, dump trucks, drills, and loaders. Specialized equipment like autonomous haulers and electric-powered machines are increasingly adopted for efficiency and environmental compliance.

Q: How is technology transforming construction and mining equipment?

A: Technologies like telematics, GPS tracking, and predictive maintenance enhance operational efficiency and safety. Electrification and autonomous operation systems are reducing emissions and labor costs in harsh environments.

Q: What safety standards govern mining and construction equipment operations?

A: Equipment must comply with ISO 20474 (earth-moving machinery) and regional regulations like OSHA standards. Manufacturers prioritize features like rollover protection and collision avoidance systems to meet safety requirements.

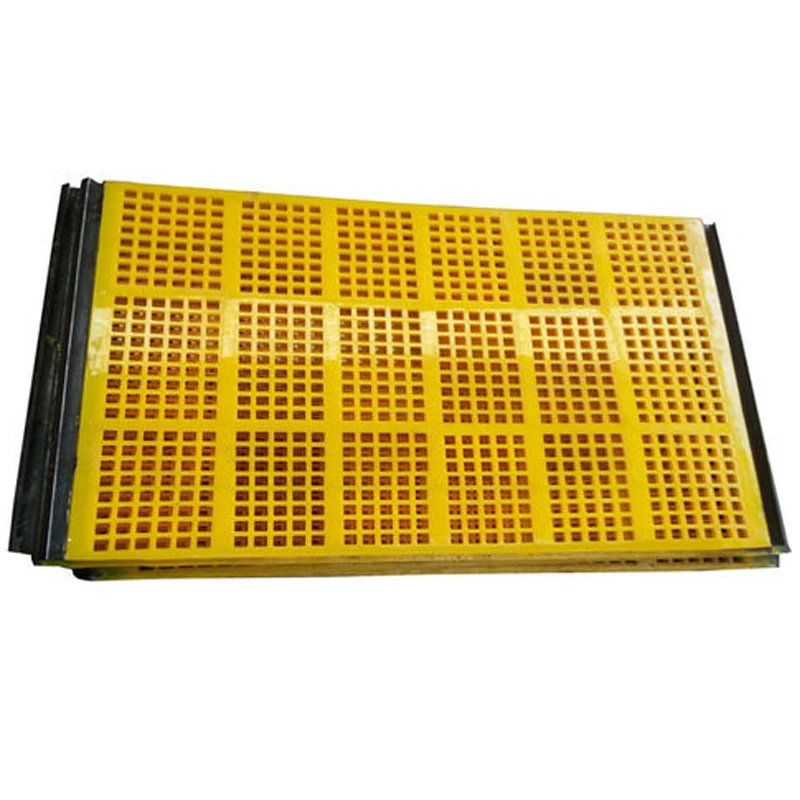

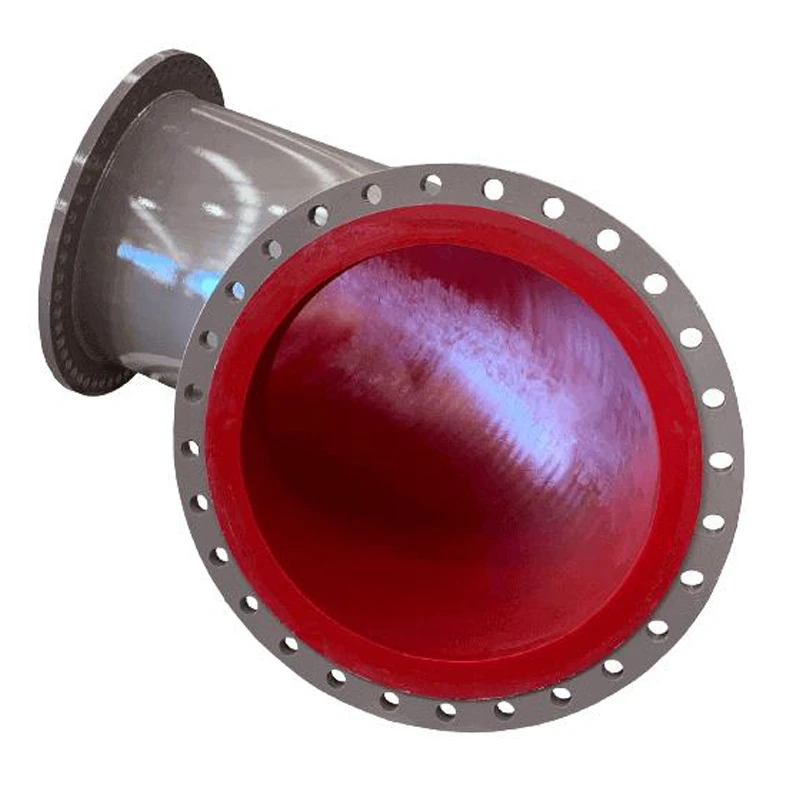

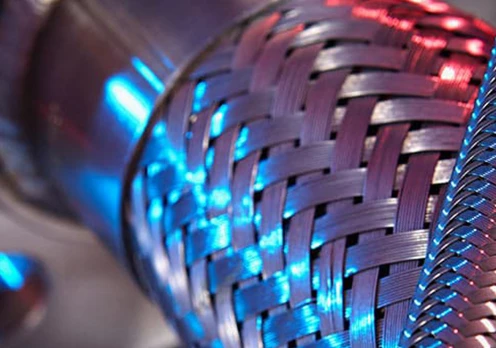

Related Products

Our main products are polyurethane lined pipes, mining equipment fittings and metal hoses.